A balance transfer is a financial transaction where an individual moves existing debt from one credit card account to another. This process typically involves transferring the outstanding balance from a high-interest credit card to a new credit card offering a lower interest rate or a promotional period with 0% APR (Annual Percentage Rate) on balance transfers.

By transferring the balance to a card with a lower interest rate or a promotional offer, individuals aim to save money on interest charges, simplify debt management, and potentially pay off their debt more efficiently. Balance transfers can be beneficial for individuals seeking to consolidate multiple credit card balances into one account, enabling them to streamline their finances and focus on repaying their debt more effectively.

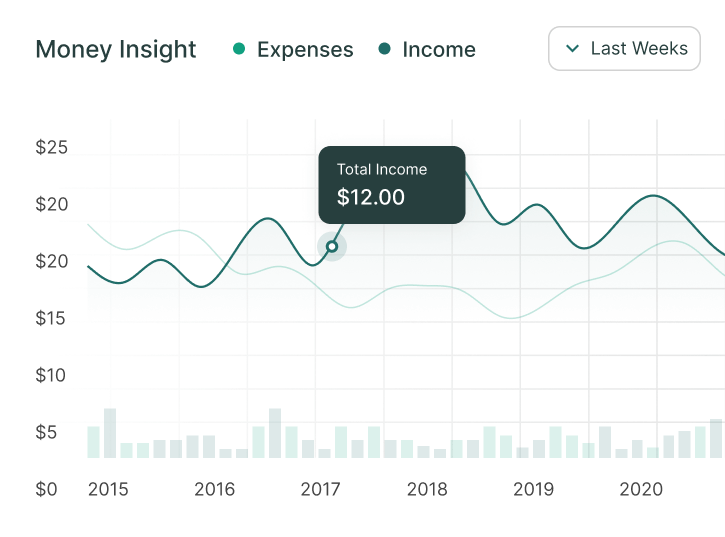

How much can I save with a balance transfer?

- Calculate Current Interest Costs: Start by determining how much interest you’re currently paying on your existing debts each month. Multiply the outstanding balance of each debt by its respective interest rate to find the total monthly interest cost.

- Compare with Balance Transfer Offer: Next, compare the interest rate on the balance transfer card’s promotional APR period. If the promotional APR is 0% or significantly lower than your current interest rates, you can potentially save money on interest charges during the promotional period.

- Estimate Savings: Calculate the total interest you would pay during the promotional period if you transferred your existing debt to the balance transfer card. This can be done by multiplying the outstanding balance by the promotional APR and dividing by 12 (to get the monthly interest cost), then multiplying by the number of months in the promotional period.

- Compare Costs: Compare the total interest you would pay with the balance transfer card to the interest you’re currently paying on your existing debts. The difference between these amounts represents your potential savings with the balance transfer.

- Consider Balance Transfer Fees: Remember to factor in any balance transfer fees charged by the new card issuer. Most balance transfer cards charge a fee, typically ranging from 3% to 5% of the transferred amount. Subtract this fee from your estimated savings to get a more accurate picture of your net savings.

- Evaluate Repayment Strategy: Lastly, consider your repayment strategy. To maximize savings, aim to pay off the transferred balance in full before the promotional APR period ends. Calculate the monthly payments required to achieve this goal and ensure they fit within your budget.

By following these steps, you can estimate the potential savings you could achieve with a balance transfer. Keep in mind that the actual amount saved may vary based on factors such as changes in interest rates, repayment behavior, and any unforeseen expenses. It’s essential to carefully review the terms and conditions of the balance transfer offer and develop a plan to manage your debt effectively. If you’re unsure about the potential savings or the suitability of a balance transfer for your situation, consider consulting with a financial advisor for personalized guidance.

Pros and Cons:-

Pros

- Lower Interest Rates: Balance transfer cards often offer a low or 0% introductory APR on transferred balances for a specified period, typically ranging from 12 to 21 months. This can help you save money on interest charges and pay off debt faster.

- Debt Consolidation: Consolidating multiple high-interest debts onto a single balance transfer card can simplify your finances and make it easier to manage payments. Instead of juggling multiple accounts and due dates, you’ll have one monthly payment to track.

- Potential Savings: By taking advantage of a balance transfer offer with a lower interest rate, you can save money on interest charges and potentially pay off debt more quickly. This can lead to significant savings over time, especially if you have high-interest debt.

- Financial Flexibility: A balance transfer card can provide financial flexibility by giving you time to pay off transferred balances without accruing interest. This can free up cash flow for other financial goals or emergencies.

- Credit Score Improvement: Successfully managing debt through a balance transfer card can have a positive impact on your credit score. Timely payments and reducing credit utilization can improve your creditworthiness over time.

Cons

- Balance Transfer Fees: Most balance transfer cards charge a fee, typically ranging from 3% to 5% of the transferred amount. While the savings from a lower interest rate may outweigh the fee, it’s essential to consider this cost when evaluating the overall benefits.

- Promotional Period Limitations: The low or 0% introductory APR on balance transfers is only temporary and typically lasts for a specified period, such as 12 to 21 months. After the promotional period ends, any remaining balance will be subject to the card’s regular APR, which may be higher.

- Credit Score Impact: Applying for a new credit card can result in a temporary dip in your credit score due to the inquiry and new account opening. Additionally, closing existing accounts after transferring balances can affect your credit utilization ratio and credit history length.

- Risk of Overspending: While a balance transfer card can provide relief from high-interest debt, it’s essential to avoid using the card for new purchases or accumulating additional debt. Without disciplined spending habits, you may end up in a worse financial situation.

- Not Suitable for Everyone: Balance transfer cards are most beneficial for individuals with existing high-interest debt who can realistically pay off the transferred balance within the promotional period. If you’re unable to make timely payments or repay the debt before the promotional period ends, you may incur higher interest charges and fees.