Financial Advisors

Financial advisors are professionals who provide expert guidance and advice on various aspects of financial planning and wealth management. They work closely with individuals, families, and businesses to help them achieve their financial goals, manage their assets, and plan for the future. The role of financial advisors is to offer personalized and comprehensive financial guidance tailored to the unique circumstances and objectives of each client.

Types of financial advisors

-

- Registered Investment Advisors (RIAs):RIAs are financial professionals or firms registered with the Securities and Exchange Commission (SEC) or state securities regulators. They have a fiduciary duty to act in their clients’ best interests. RIAs provide comprehensive investment management services, including portfolio construction, asset allocation, investment selection, and ongoing monitoring and rebalancing. They typically work with individuals, families, and institutional clients to manage investment portfolios, optimize returns, and achieve long-term financial goals. RIAs may charge fees based on a percentage of assets under management (AUM), hourly rates, or flat fees for their services.

- Certified Financial Planners (CFPs):CFPs are financial professionals who have completed rigorous education, examination, experience, and ethics requirements set by the Certified Financial Planner Board of Standards (CFP Board). CFPs are trained to provide holistic financial planning services covering various aspects of financial management, including retirement planning, investment management, tax planning, estate planning, insurance analysis, and budgeting. They work with individuals and families to develop comprehensive financial plans tailored to their unique goals, needs, and circumstances. CFPs adhere to a fiduciary standard when providing financial advice, meaning they are required to act in their clients’ best interests.

- Wealth Managers: Wealth managers are financial professionals or firms that specialize in providing comprehensive wealth management services to high-net-worth individuals, families, and institutional clients.They offer personalized financial planning, investment management, estate planning, tax planning, risk management, and other specialized services designed to preserve and grow clients’ wealth over time.Wealth managers take a holistic approach to wealth management, considering clients’ entire financial picture, including assets, liabilities, income, expenses, and long-term goals.They often collaborate with other professionals, such as attorneys, accountants, and insurance specialists, to develop integrated wealth management strategies tailored to clients’ needs.Wealth managers may charge fees based on a percentage of assets under management (AUM), flat fees, or retainer fees for their services.

- Financial Advisors at Brokerage Firms:Financial advisors at brokerage firms are professionals who work for brokerage firms and provide investment advice, financial planning, and brokerage services to clients.They may hold various designations, licenses, or certifications, such as Chartered Financial Analyst (CFA), Certified Investment Management Analyst (CIMA), or Series 7 and Series 66 licenses.Financial advisors at brokerage firms may offer a range of investment products, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and annuities.They may earn commissions, fees, or a combination of both for their services, depending on the products and services offered.

- Insurance Agents and Financial Planners:Insurance agents and financial planners are professionals who specialize in providing insurance products and financial planning services to clients.They may offer a range of insurance products, including life insurance, disability insurance, long-term care insurance, and annuities, as well as financial planning services such as retirement planning, estate planning, and investment advice.Insurance agents and financial planners may be compensated through commissions, fees, or a combination of both, depending on the products and services offered.

Each type of financial advisor has its own areas of expertise, services offered, fee structures, and regulatory requirements. When choosing a financial advisor, it’s essential to consider factors such as qualifications, experience, fiduciary status, services provided, and compatibility with your financial goals and preferences. Working with a trusted and qualified advisor can help you make informed financial decisions and achieve your long-term financial objectives.

Services Offered by Financial Advisors:

Financial advisors offer a comprehensive range of services designed to help individuals, families, and businesses achieve their financial goals and secure their financial future.

- Retirement Planning:

Financial advisors assist clients in setting and achieving retirement goals by analyzing current financial status, estimating future retirement expenses, and developing strategies to accumulate savings for retirement.They help clients maximize retirement contributions to employer-sponsored plans (e.g., 401(k), 403(b)) and individual retirement accounts (IRAs), taking into account tax implications and investment options.Advisors create retirement income projections, evaluate social security claiming strategies, and recommend distribution strategies to sustain income throughout retirement. - Investment Management:

Financial advisors provide professional investment management services tailored to clients’ risk tolerance, time horizon, and financial objectives.They develop customized investment portfolios comprised of a diversified mix of asset classes, such as stocks, bonds, mutual funds, ETFs, and alternative investments.Advisors actively monitor investment performance, rebalance portfolios as needed, and adjust investment strategies based on market conditions and client preferences. - Tax Planning:

Financial advisors offer tax planning strategies to minimize tax liabilities and optimize tax efficiency for clients.They analyze clients’ tax situations, identify potential tax-saving opportunities, and recommend tax-efficient investment strategies, retirement contributions, and charitable giving.Advisors stay abreast of changes in tax laws and regulations, providing proactive advice and guidance to help clients reduce tax burdens and maximize after-tax returns. - Estate Planning:

Financial advisors assist clients in developing comprehensive estate plans to manage and distribute their assets according to their wishes while minimizing estate taxes and probate costs.They collaborate with estate planning professionals, such as attorneys and trust officers, to create wills, trusts, powers of attorney, healthcare directives, and beneficiary designations.Advisors address complex estate planning issues, such as asset protection, charitable giving, business succession, and legacy planning, to ensure clients’ wishes are fulfilled and their wealth is preserved for future generations. - Insurance Planning:

Financial advisors assess clients’ insurance needs and recommend appropriate insurance solutions to protect against unforeseen events and liabilities.They analyze existing insurance coverage, including life insurance, disability insurance, long-term care insurance, and property and casualty insurance, to ensure clients have adequate protection in place.Advisors help clients understand insurance options, compare policy features and costs, and select the most suitable coverage to mitigate risks and safeguard financial well-being. - Debt Management:

Financial advisors help clients manage debt effectively by developing strategies to reduce debt levels, lower interest costs, and improve overall financial health.They analyze clients’ debt obligations, including mortgages, credit cards, student loans, and other loans, and recommend repayment strategies based on interest rates, terms, and financial priorities.Advisors provide guidance on debt consolidation, refinancing, and repayment plans to help clients achieve debt reduction goals and improve cash flow.

Financial advisors tailor their services to meet the unique needs and goals of each client by conducting thorough assessments of clients’ financial situations, understanding their objectives and priorities, and developing customized financial plans and strategies accordingly. They take into account factors such as risk tolerance, time horizon, income level, family dynamics, career stage, and life events to ensure clients receive personalized advice and guidance that aligns with their individual circumstances and aspirations.

Health Insurance

Cash Out Refi

Home Equity Rates

Access advanced tools, exclusive saving insights, ad-free experience

Unlock access to advanced tools, exclusive savings insights, and enjoy an ad-free experience with our premium membership. Upgrade today to elevate your user experience and maximize your benefits.

Earn way more on savings

Maximize your savings potential and earn significantly higher returns with our innovative savings solutions. Discover how you can optimize your finances and achieve your financial goals faster. Start earning more on your savings today

Build your wealth with 100.000+ users worldwide!

Enjoy peace of mind while effortlessly growing your funds

Bank account integration

Connect your accounts effortlessly to access real-time insights, automate transactions, and optimize your finances. Experience the convenience of consolidated banking and unlock new possibilities for financial growth.

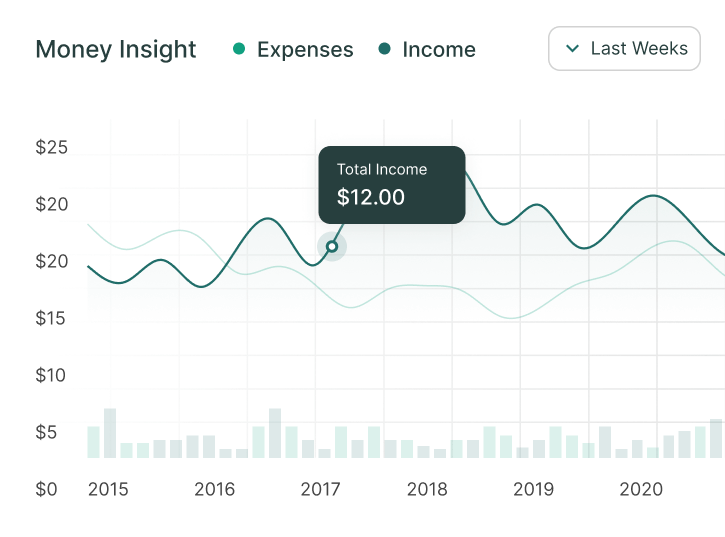

Investment insights

Gain valuable investment insights to make informed decisions and maximize your financial returns. Our comprehensive analysis and expert recommendations help you navigate the complexities of the market with confidence.

Goal tracking

Track and achieve your financial goals with precision using our intuitive goal tracking tools. Set personalized targets, monitor progress, and receive actionable insights to stay on course towards financial success.

Customizable reports

Elevate your financial management with customizable reports tailored to your unique needs. Gain deep insights into your spending patterns, investment performance, and overall financial health.

Sync across devices

Synchronize your financial data seamlessly across all your devices for unparalleled convenience and accessibility.

Management help

Get the management help you need to take control of your finances and achieve your goals. Our comprehensive tools and expert guidance empower you to make informed decisions, streamline your financial processes.