Cash Out Refi

Cash-out refinancing is a financial strategy where homeowners refinance their existing mortgage for an amount greater than what they currently owe on their home. This allows them to receive the difference between the new loan amount and their current mortgage balance in the form of cash. Homeowners often use this cash for various purposes such as home improvements, debt consolidation, education expenses, or other financial needs. Cash-out refinancing typically involves securing a new mortgage with different terms and interest rates than the existing mortgage. However, it’s essential for homeowners to carefully consider the costs, benefits, and long-term implications before proceeding with a cash-out refinance. Consulting with a mortgage professional or financial advisor can provide valuable guidance in determining whether cash-out refinancing is the right option for their financial situation and goals.

How It Works:

To initiate a cash-out refinance, homeowners apply for a new mortgage loan with a higher principal balance than their current mortgage. The lender pays off the existing mortgage and disburses the difference to the homeowner in the form of a lump sum cash payment.

Benefits of Cash Out Refi:

- Access to Cash: Cash-out refinancing provides homeowners with access to a lump sum of cash, which can be used to fund home renovations, pay off high-interest debt, or cover other expenses.

- Potentially Lower Interest Rates: If the new mortgage has a lower interest rate than the existing mortgage, homeowners may benefit from lower monthly payments and reduced interest costs over the life of the loan.

- Consolidation of Debt: By paying off high-interest debt with the cash received from a cash-out refinance, homeowners can consolidate their debt into a single, potentially lower-interest loan.

Cash-out refinancing can be a useful financial tool for homeowners seeking to access the equity in their homes. However, it’s essential to carefully evaluate the costs, benefits, and long-term implications before proceeding with a cash-out refinance. Consulting with a mortgage professional or financial advisor can provide valuable guidance and assistance in determining whether cash-out refinancing is the right option for your financial needs and goals.

Access advanced tools, exclusive saving insights, ad-free experience

Unlock access to advanced tools, exclusive savings insights, and enjoy an ad-free experience with our premium membership. Upgrade today to elevate your user experience and maximize your benefits.

Earn way more on savings

Maximize your savings potential and earn significantly higher returns with our innovative savings solutions. Discover how you can optimize your finances and achieve your financial goals faster. Start earning more on your savings today

Build your wealth with 100.000+ users worldwide!

Enjoy peace of mind while effortlessly growing your funds

Bank account integration

Connect your accounts effortlessly to access real-time insights, automate transactions, and optimize your finances. Experience the convenience of consolidated banking and unlock new possibilities for financial growth.

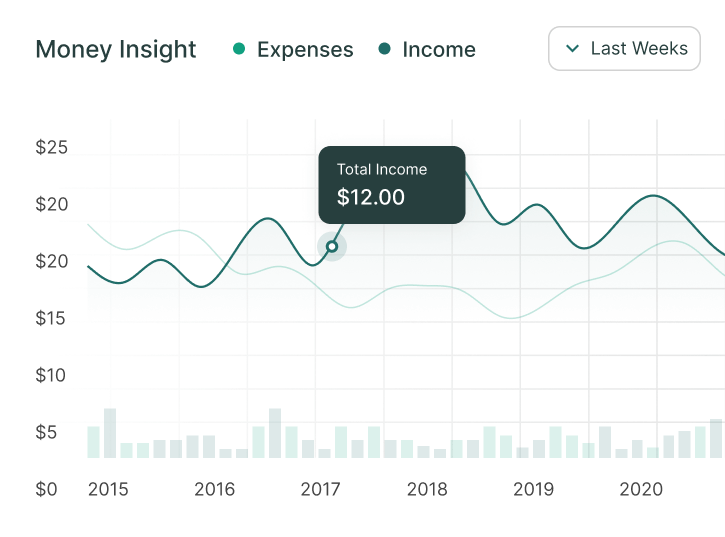

Investment insights

Gain valuable investment insights to make informed decisions and maximize your financial returns. Our comprehensive analysis and expert recommendations help you navigate the complexities of the market with confidence.

Goal tracking

Track and achieve your financial goals with precision using our intuitive goal tracking tools. Set personalized targets, monitor progress, and receive actionable insights to stay on course towards financial success.

Customizable reports

Elevate your financial management with customizable reports tailored to your unique needs. Gain deep insights into your spending patterns, investment performance, and overall financial health.

Sync across devices

Synchronize your financial data seamlessly across all your devices for unparalleled convenience and accessibility.

Management help

Get the management help you need to take control of your finances and achieve your goals. Our comprehensive tools and expert guidance empower you to make informed decisions, streamline your financial processes.