CDs

In today’s uncertain financial landscape, finding secure and profitable avenues to grow your savings is paramount. One such option that often flies under the radar but deserves serious consideration is the Certificate of Deposit, commonly known as a CD. In this blog post, we’ll delve into what CDs are, how they work, and why they might be the perfect addition to your financial strategy.

What is a Certificate of Deposit (CD)?

At its core, a Certificate of Deposit is a financial product offered by banks and credit unions that allows you to deposit a sum of money for a fixed period, ranging from a few months to several years. In return, the bank typically offers a higher interest rate than a standard savings account. This higher rate comes with the condition that you agree not to withdraw the funds until the CD reaches maturity. CDs are known for their safety and stability, making them an attractive option for conservative investors or those looking to diversify their savings strategy.

How Do CDs Work?

When you open a CD, you’ll select the amount of money you want to deposit and choose the length of the term, known as the maturity period. The longer the term, the higher the interest rate typically offered by the bank. Once your CD is established, the bank will lock in the interest rate for the duration of the term, providing predictability and security for your investment.

Unlike savings accounts, which offer liquidity with unlimited withdrawals, CDs have restrictions on accessing your funds. If you withdraw money from a CD before it matures, you’ll likely incur penalties, such as forfeiting a portion of the interest earned or even paying a fee on the principal amount. Therefore, it’s crucial to consider your financial goals and liquidity needs before committing to a CD.

Benefits of CDs:

- Higher Interest Rates: CDs often provide higher interest rates compared to traditional savings accounts, allowing your money to grow more quickly over time.

- Safety and Stability: With FDIC insurance (for banks) or NCUA insurance (for credit unions) covering deposits up to $250,000 per depositor per institution, CDs offer a secure way to grow your savings without the risks associated with investing in the stock market.

- Fixed Returns: The interest rate on a CD remains fixed for the entire term, shielding you from fluctuations in the market and providing certainty about your investment’s growth.

- Diversification: Including CDs in your investment portfolio can diversify your risk exposure and provide a stable foundation alongside more volatile assets.

Is a CD Right for You?

While CDs offer numerous benefits, they may not be suitable for everyone. If you anticipate needing access to your funds in the near future or if you’re seeking higher returns than what CDs typically offer, you may want to explore alternative investment options. Additionally, with interest rates being relatively low, it’s essential to shop around and compare CD rates from different financial institutions to ensure you’re getting the best deal.

In conclusion, Certificates of Deposit present a compelling opportunity for individuals to grow their savings with safety and stability. By understanding how CDs work and weighing their benefits against your financial objectives, you can make an informed decision about whether to incorporate them into your savings strategy. Whether you’re saving for a short-term goal or building a long-term nest egg, CDs can be a valuable tool in your financial toolkit.

Access advanced tools, exclusive saving insights, ad-free experience

Unlock access to advanced tools, exclusive savings insights, and enjoy an ad-free experience with our premium membership. Upgrade today to elevate your user experience and maximize your benefits.

Earn way more on savings

Maximize your savings potential and earn significantly higher returns with our innovative savings solutions. Discover how you can optimize your finances and achieve your financial goals faster. Start earning more on your savings today

Build your wealth with 100.000+ users worldwide!

Enjoy peace of mind while effortlessly growing your funds

Bank account integration

Connect your accounts effortlessly to access real-time insights, automate transactions, and optimize your finances. Experience the convenience of consolidated banking and unlock new possibilities for financial growth.

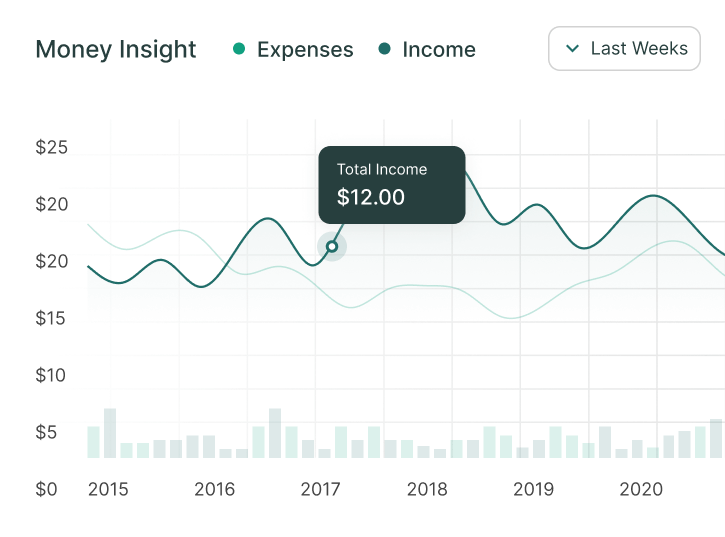

Investment insights

Gain valuable investment insights to make informed decisions and maximize your financial returns. Our comprehensive analysis and expert recommendations help you navigate the complexities of the market with confidence.

Goal tracking

Track and achieve your financial goals with precision using our intuitive goal tracking tools. Set personalized targets, monitor progress, and receive actionable insights to stay on course towards financial success.

Customizable reports

Elevate your financial management with customizable reports tailored to your unique needs. Gain deep insights into your spending patterns, investment performance, and overall financial health.

Sync across devices

Synchronize your financial data seamlessly across all your devices for unparalleled convenience and accessibility.

Management help

Get the management help you need to take control of your finances and achieve your goals. Our comprehensive tools and expert guidance empower you to make informed decisions, streamline your financial processes.