Personal

Personal loans are versatile financial tools that can provide individuals with the funds they need for various purposes, from consolidating debt to covering unexpected expenses. However, understanding how personal loans work and making informed borrowing decisions is essential to avoid financial pitfalls. In this comprehensive guide, we’ll explore everything you need to know about personal loans, including their features, benefits, potential drawbacks.

Understanding Personal Loans:

Personal loans are financial products offered by banks, credit unions, or online lenders, providing borrowers with a lump sum of money that is repaid over time with interest. These loans are unsecured, meaning they do not require collateral such as a car or house to secure the loan. Borrowers can typically use personal loans for various purposes, including debt consolidation, home improvements, medical expenses, or other personal expenses. The terms and conditions of personal loans, including the loan amount, interest rate, and repayment period, vary depending on the lender and the borrower’s creditworthiness.

How Do Personal Loans Work:

Application Process:

- Borrowers apply for personal loans by submitting an application to a lender, either online, in person, or over the phone.

- The application requires personal information such as name, address, date of birth, Social Security number, employment details, income, and details about the purpose of the loan.

- Some lenders may also require documentation such as pay stubs, bank statements, or tax returns to verify income and employment.

Credit Check and Approval:

- Once the application is submitted, the lender evaluates the borrower’s creditworthiness by conducting a credit check.

- Lenders consider factors such as credit score, income, employment history, debt-to-income ratio, and credit history to assess the borrower’s ability to repay the loan.

- Based on the evaluation, the lender decides whether to approve or deny the loan application.

Loan Terms and Conditions:

- If approved, the lender provides the borrower with a loan offer outlining the terms and conditions of the loan.

- This includes the loan amount, interest rate, repayment period, monthly payment amount, any fees or charges associated with the loan, and other relevant details.

- Borrowers should carefully review the loan offer to understand the cost of borrowing and ensure it meets their needs before accepting the terms.

Disbursement of Funds:

- Upon acceptance of the loan offer, the lender disburses the funds to the borrower.

- Depending on the lender and the borrower’s preferences, funds may be deposited directly into the borrower’s bank account, provided as a check, or transferred through other means.

Repayment:

- Borrowers repay the loan over time through regular monthly payments, typically over a fixed repayment period ranging from one to seven years.

- Each payment consists of a portion of the principal amount borrowed plus interest, with the total amount due calculated to ensure the loan is repaid in full by the end of the term.

- It’s essential for borrowers to make timely payments to avoid late fees, penalties, and potential damage to their credit score.

Interest and Fees:

- Personal loans accrue interest over the repayment period, based on the interest rate specified in the loan agreement.

- Some lenders may also charge origination fees, prepayment penalties, or other fees associated with the loan, which borrowers should be aware of before accepting the loan offer.

Completion of Loan:

- Once the borrower has made all scheduled payments according to the loan agreement, the loan is considered repaid in full, and the borrowing relationship with the lender concludes

Pros and Cons of Personal Loans

Pros:

- Flexibility:Personal loans offer flexibility in terms of usage. Borrowers can use the funds for various purposes, such as debt consolidation, home improvements, medical expenses, education expenses, or even funding a vacation. There are typically no restrictions on how the funds are used, providing borrowers with versatility.

- No Collateral Required:Unlike secured loans that require collateral (e.g., home or car) to secure the loan, personal loans are typically unsecured. This means borrowers do not have to pledge assets as security for the loan. As a result, borrowers do not risk losing their assets if they default on the loan.

- Fixed Interest Rates:Many personal loans come with fixed interest rates, meaning the interest rate remains constant throughout the loan term. Fixed rates provide predictability, allowing borrowers to budget more effectively since they know the exact amount of their monthly payments. This is particularly beneficial in times of rising interest rates, as borrowers are protected from rate hikes.

- Fixed Repayment Terms:Personal loans usually have fixed repayment terms, meaning borrowers repay the loan over a predetermined period through fixed monthly installments. Fixed terms make it easier for borrowers to plan their finances and ensure timely repayment, ultimately reducing the risk of default.

- Quick Access to Funds:Personal loans often have a streamlined application process and quick approval turnaround times. Once approved, funds are typically disbursed promptly, often within a few business days. This makes personal loans an ideal option for addressing urgent financial needs or unexpected expenses.

- Credit Building Opportunity:Making timely payments on a personal loan can positively impact the borrower’s credit score. Consistent repayment demonstrates responsible financial behavior to credit bureaus, potentially leading to an improvement in creditworthiness over time. This can have long-term benefits, such as qualifying for lower interest rates on future loans.

Cons

- Higher Interest Rates:Personal loans often come with higher interest rates compared to secured loans, such as mortgages or auto loans. The absence of collateral poses a higher risk to lenders, leading to higher interest rates to compensate for the risk. Borrowers with lower credit scores may face even higher rates, further increasing the cost of borrowing.

- Origination Fees and Other Costs:Some lenders charge origination fees or other upfront costs associated with personal loans. These fees can vary significantly among lenders and add to the overall cost of borrowing. Borrowers should carefully review the terms and conditions, including all fees, before committing to a personal loan.

- Potential for Overborrowing:Access to quick cash with personal loans may tempt some borrowers to borrow more than necessary. Overborrowing can lead to financial strain and difficulties in repaying the loan, potentially resulting in missed payments or default. Borrowers should only borrow what they truly need and can afford to repay comfortably.

- Impact on Credit Score:Applying for a personal loan results in a hard inquiry on the borrower’s credit report. While a single inquiry may have a minor impact on credit scores, multiple inquiries within a short period can lower scores further. Additionally, missed or late payments on a personal loan can negatively impact credit scores, potentially affecting the borrower’s ability to qualify for future credit.

- Risk of Default:Failure to repay a personal loan can have serious consequences, including damage to credit scores, collection efforts by the lender, and potential legal action. Defaulting on a personal loan can significantly impact the borrower’s financial health and future borrowing capabilities. Borrowers should carefully consider their repayment ability and financial circumstances before taking out a personal loan.

Personal loans offer flexibility and quick access to funds for various purposes, but they come with potential drawbacks such as higher interest rates, fees, and the risk of overborrowing or default. Borrowers should weigh the pros and cons carefully, compare loan offers from multiple lenders, and ensure they can comfortably afford the monthly payments before taking out a personal loan.

Access advanced tools, exclusive saving insights, ad-free experience

Unlock access to advanced tools, exclusive savings insights, and enjoy an ad-free experience with our premium membership. Upgrade today to elevate your user experience and maximize your benefits.

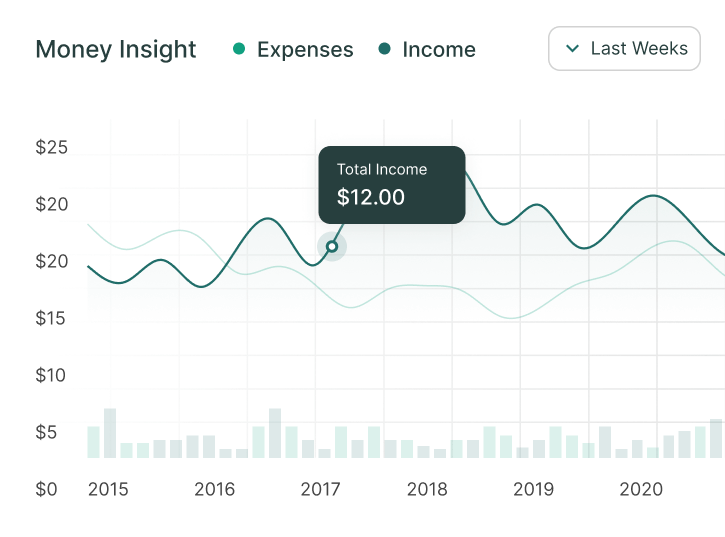

Earn way more on savings

Maximize your savings potential and earn significantly higher returns with our innovative savings solutions. Discover how you can optimize your finances and achieve your financial goals faster. Start earning more on your savings today

Build your wealth with 100.000+ users worldwide!

Enjoy peace of mind while effortlessly growing your funds

Bank account integration

Connect your accounts effortlessly to access real-time insights, automate transactions, and optimize your finances. Experience the convenience of consolidated banking and unlock new possibilities for financial growth.

Investment insights

Gain valuable investment insights to make informed decisions and maximize your financial returns. Our comprehensive analysis and expert recommendations help you navigate the complexities of the market with confidence.

Goal tracking

Track and achieve your financial goals with precision using our intuitive goal tracking tools. Set personalized targets, monitor progress, and receive actionable insights to stay on course towards financial success.

Customizable reports

Elevate your financial management with customizable reports tailored to your unique needs. Gain deep insights into your spending patterns, investment performance, and overall financial health.

Sync across devices

Synchronize your financial data seamlessly across all your devices for unparalleled convenience and accessibility.

Management help

Get the management help you need to take control of your finances and achieve your goals. Our comprehensive tools and expert guidance empower you to make informed decisions, streamline your financial processes.